Dravan Exchange has secured its U.S. FinCEN MSB license, marking a key milestone in its global compliance strategy and strengthening its position in the North American market.

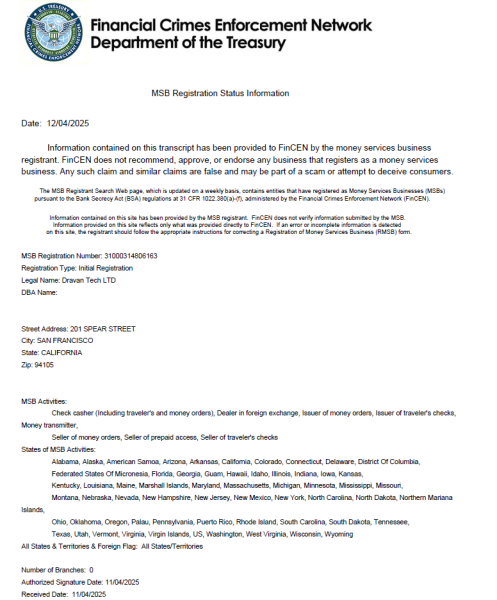

United States, 9th Dec 2025, Grand Newswire – Dravan Exchange announced that it has officially obtained the Money Services Business (MSB) license issued by the Financial Crimes Enforcement Network (FinCEN) of the United States. This regulatory milestone marks a decisive step forward in the company’s global compliance roadmap and strengthens its foundation for further expansion into the North American market.

A Significant Milestone in Regulatory Alignment

The MSB license is a core legal requirement for entering the U.S. digital asset services market.

Dravan Exchange’s successful approval signifies that its platform architecture and risk control systems fully meet U.S. regulatory expectations, including robust capabilities in data governance, identity management, anti-money laundering (AML) procedures, and customer due diligence (CDD) standards.

During the compliance preparation phase, Dravan Exchange completed a series of technical upgrades to support regulatory readiness, including:

ZK-KYC on-chain identity verification modules

Cross-chain data isolation strategies

Multi-dimensional audit interfaces for supervisory review

These enhancements provided the technical foundation required to pass FinCEN’s stringent oversight and ensure long-term operational compliance.

CaaS Framework Enables Scalable Compliance Across Jurisdictions

Dravan Exchange has adopted a Compliance-as-a-Service (CaaS) architectural model, offering adaptable compliance capabilities for both its own platform and ecosystem partners.

By establishing a three-layer model across identity, transaction, and data domains, Dravan Exchange can dynamically adjust:

User permissions

Transaction boundaries

Data retention and storage rules

based on specific regulatory requirements in different jurisdictions.

This flexible model allows the platform to maintain high regulatory efficiency while preserving strong user privacy protections.

Meeting Global Expectations for AML, Transparency, and Operational Integrity

With regulatory scrutiny increasing worldwide, obtaining the U.S. MSB license confirms that Dravan Exchange meets U.S. standards for anti-money laundering, funds movement tracking, and operational transparency.

This achievement not only enhances the legal security of the platform but also increases its attractiveness to institutional clients and traditional financial partners evaluating digital asset collaboration opportunities.

Leadership Statement

Madeline Cross, Vice President of Regulatory Affairs at Dravan Exchange, commented:

“Securing the MSB license is a pivotal milestone for Dravan Exchange. It reflects our commitment to aligning with the world’s most rigorous regulatory systems and reinforces our dedication to building a transparent, secure, and institution-ready digital asset marketplace.”

Driving the Future of Trust-Based Digital Finance

As the digital asset sector moves toward greater institutionalization, compliance capability has become a defining indicator of a platform’s long-term potential.

Following the approval of its MSB license, Dravan Exchange plans to deepen technological cooperation with global regulators, advance its vision of ‘trusted liquidity,’ and contribute to building transparent, resilient digital asset infrastructure worldwide.

About Dravan Exchange

Dravan Exchange is a global digital asset platform committed to developing secure, compliant, and innovative financial infrastructure. The company offers high-performance trading systems, advanced compliance frameworks, and scalable solutions for institutional and retail users across major financial markets. Dravan Exchange continues to expand its global footprint while promoting transparency and long-term industry stability.

Media Contact

Organization: Dravan

Contact

Person: Lena Rowland

Website:

https://dravan.com/

Email:

service@dravan.com

Country:United States

The post Dravan Exchange Secures U.S. FinCEN MSB License, Advancing Its Global Compliance Strategy

appeared first on Grand Newswire.

It is provided by a third-party content provider. Grand Newswire makes no

warranties or representations in connection with it.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Bling Headlines journalist was involved in the writing and production of this article.